Table of Contents

- Tax holiday diperpanjang hingga 2025 - Infografik ANTARA News

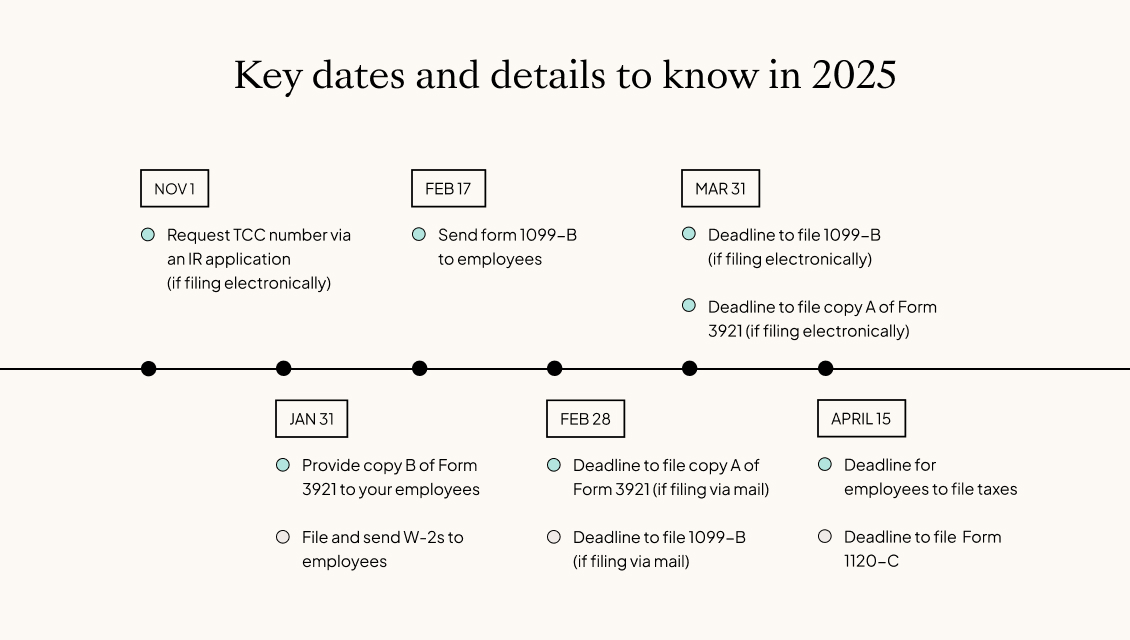

- Business Tax Deadlines 2025: Corporations and LLCs

- Tax Payment Deadline 2025 - Ardene Carlynn

- Business Tax Deadlines 2025: Corporations and LLCs

- Business Tax Deadlines 2025: Corporations and LLCs

- Tax Report 2025 Deadline - Kacy Georgine

- 2025 Tax Filing Deadline California - Taylor Casey

- Business Tax Deadlines 2025: Corporations and LLCs

- Pajak Untuk Tahun 2025 Konsep Angka Putih Pada Latar Belakang Oranye ...

- Tax Payment Deadline 2025 - Ardene Carlynn

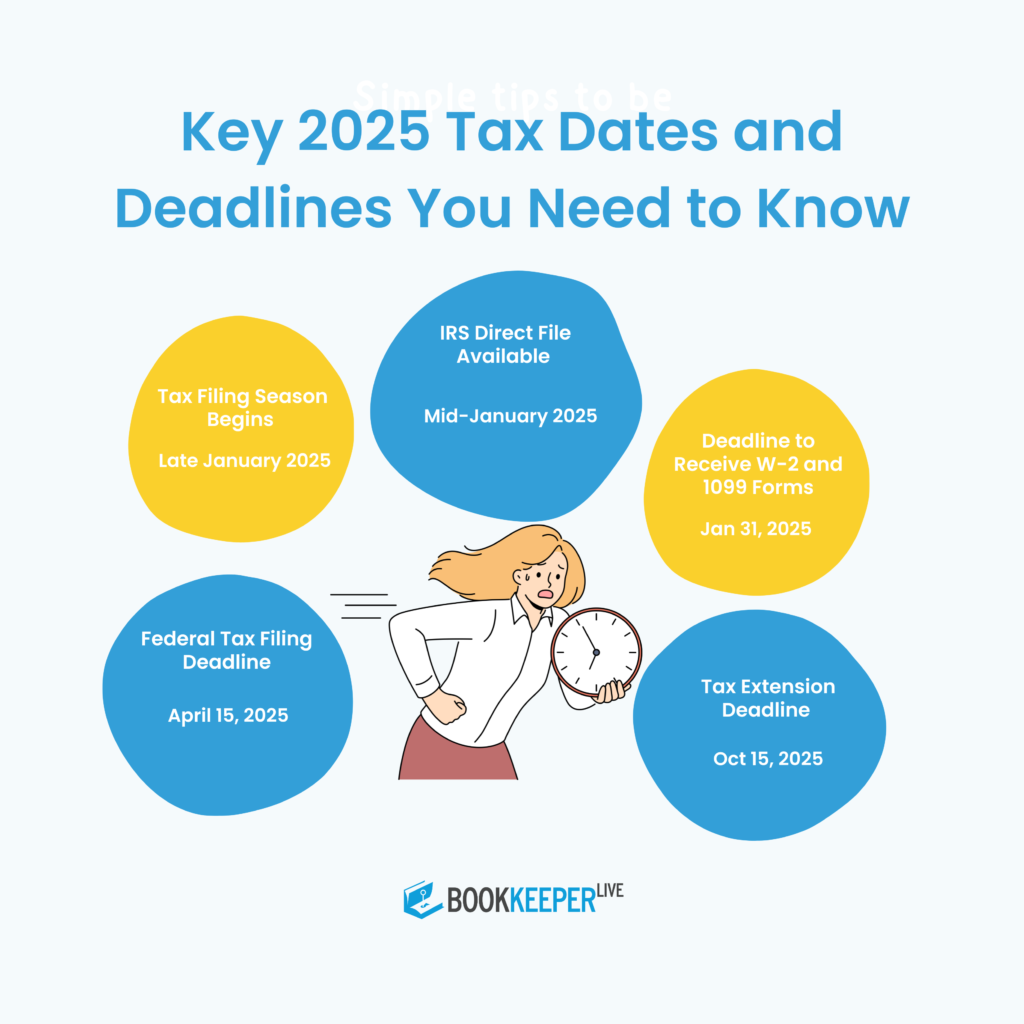

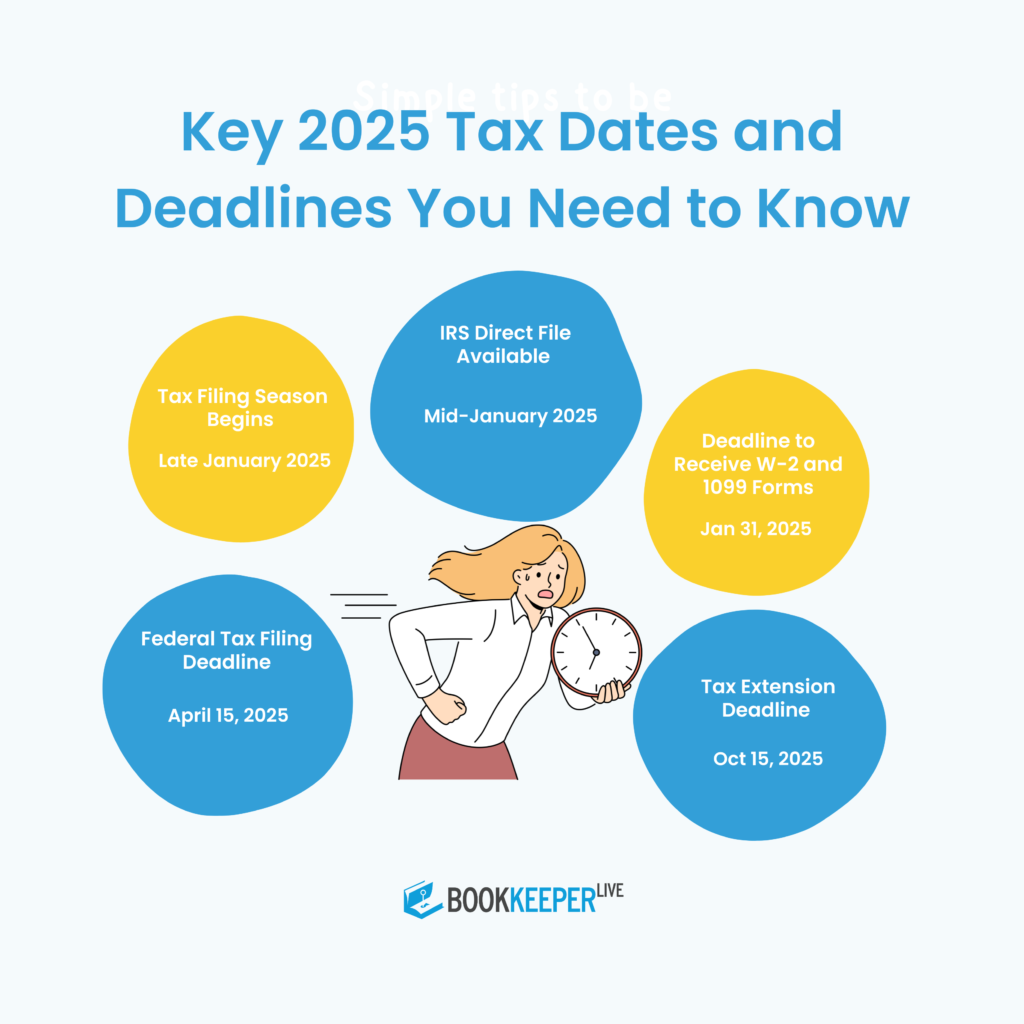

Individual Tax Deadlines

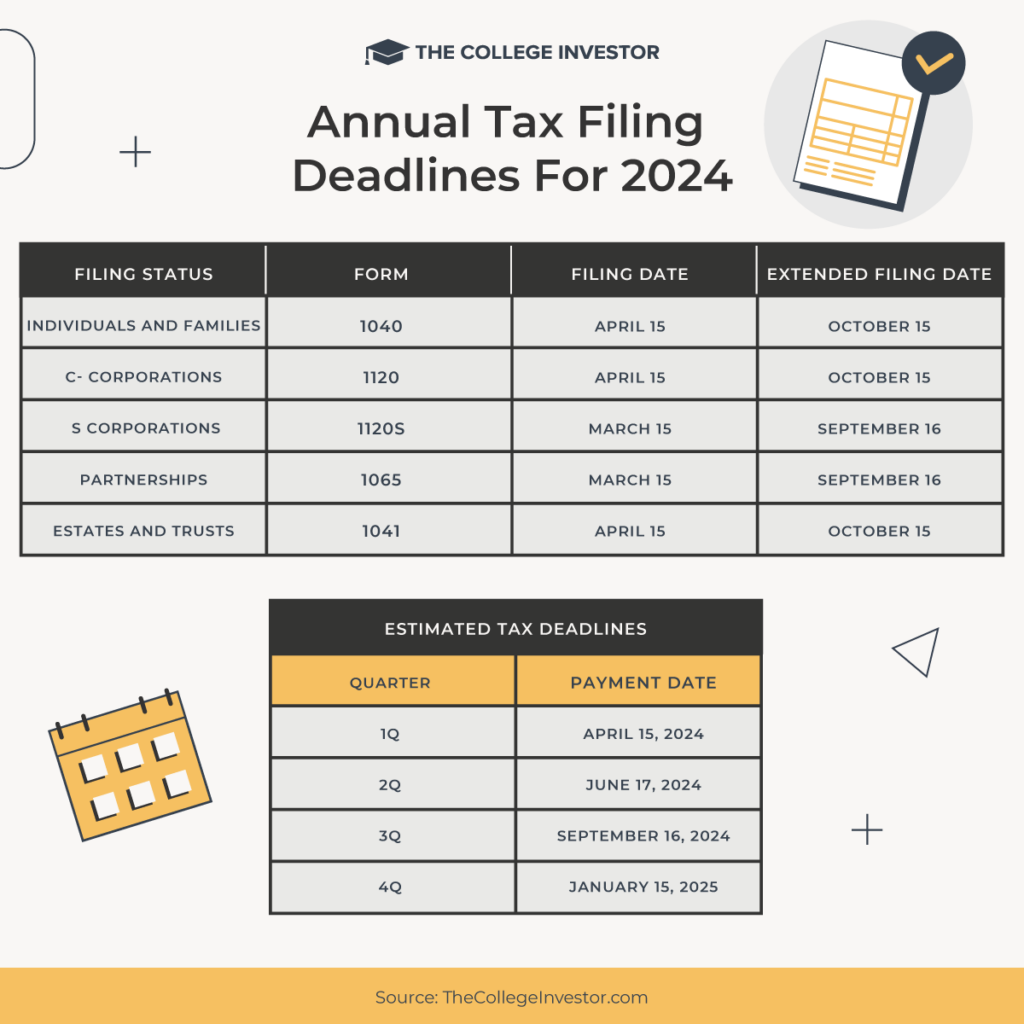

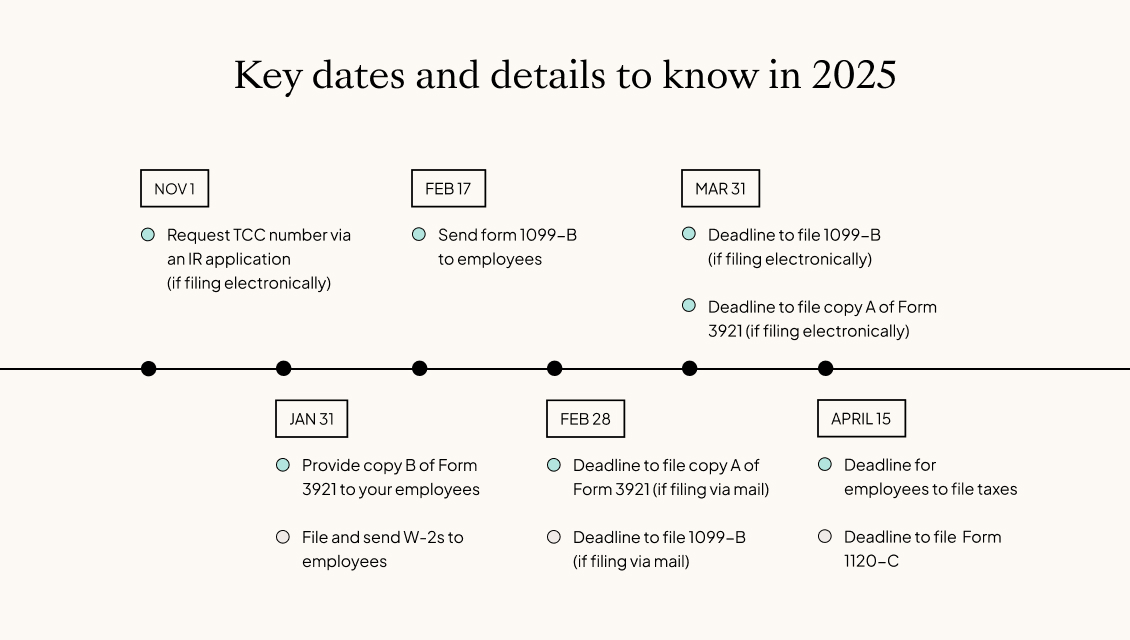

Business Tax Deadlines

Estimated Tax Deadlines

April 15, 2025: First quarter estimated tax payment due for the 2025 tax year. June 17, 2025: Second quarter estimated tax payment due. September 16, 2025: Third quarter estimated tax payment due. January 15, 2026: Fourth quarter estimated tax payment due.

Other Important Deadlines

October 15, 2025: Deadline for filing a claim for refund if you paid too much tax in 2024. April 15, 2025: Deadline for filing Form 709 (Gift Tax Return) for gifts made in 2024. In conclusion, staying on top of these essential 2025 tax deadlines is crucial to avoid penalties and ensure compliance with the IRS. Whether you're an individual or a business, mark these dates on your calendar and plan accordingly. If you're unsure about any tax-related matters, consider consulting a tax professional or seeking guidance from the IRS directly. By being proactive and informed, you can navigate the tax season with confidence and make the most of the available tax deductions and credits. Remember, it's always better to be early than late when it comes to tax deadlines, so start planning now for a stress-free tax season in 2025.Keyword: 2025 tax deadlines, U.S. News, tax season, IRS, individual tax deadlines, business tax deadlines, estimated tax deadlines.